Monthly Expense Tracker Template

Did you know that nearly 64% of Americans don’t have a budget or track their expenses regularly? This lack of financial oversight can lead to overspending and financial stress. An effective way to take control of your finances is by using a monthly expense tracker template.

These tools help you collect and classify your purchases, making it easier to identify spending patterns and areas where you can cut back. In this comprehensive guide, we’ll explore the best monthly expense tracker templates and tools available in 2025.

We’ll cover various types of expense trackers, including mobile apps, spreadsheet templates, and web-based solutions, to help you find the perfect fit for your financial needs.

Key Takeaways

- Discover the top monthly expense tracker templates and tools for 2025.

- Learn how to identify spending patterns and create effective budgets.

- Explore both free and premium options to suit different financial management needs.

- Find out how these tools can help you save money and achieve your financial goals.

- Choose the best expense tracker that aligns with your lifestyle and financial objectives.

Understanding the Importance of Tracking Your Expenses

![]()

Effective financial management starts with understanding where your money is going, making expense tracking a crucial habit. By monitoring your expenses, you can gain a clear picture of your spending habits and make informed decisions about your financial resources.

Why Financial Tracking Matters

Financial tracking is essential because it allows you to stay on top of your budget and achieve your savings goals. Without a clear understanding of your expenses, it’s easy to overspend and accumulate debt. By using an expense tracker, you can identify areas where you can cut back and allocate your funds more effectively.

Benefits of Using an Expense Tracker

Using an expense tracker offers numerous benefits, including simplified monitoring of your spending, visual representations of your spending habits, and automatic categorization of your expenses. This tool enables you to set savings goals and track your progress, helping you manage debt Many users find that an expense tracker helps them stay on track with their financial objectives, making it an indispensable resource for achieving financial stability.

What Makes a Good Expense Tracker?

![]()

A good expense tracker can make all the difference in managing your finances effectively. It is a crucial tool that helps you keep track of your expenses, identify areas where you can cut back, and make informed decisions about your financial resources.

Essential Features to Look For

When choosing an expense tracker, there are several key features to consider. These include:

- Automatic transaction import: Automatically import transactions from your bank accounts and credit cards.

- Receipt scanning: Scan receipts and automatically categorize expenses.

- Customizable categories: Customize categories to fit your specific needs.

- Reporting and analytics: Generate reports and analyze your expenses to identify trends.

Personal vs. Business Expense Tracking Needs

When it comes to expense tracking, personal and business needs differ. Personal expense trackers focus on budgeting and savings goals, while business expense trackers emphasize categorization for tax purposes and employee reimbursements. For instance:

- Business expense trackers need more robust receipt management features and the ability to handle multiple users.

- Personal expense trackers may prioritize goal-setting features and integration with personal investment accounts.

Understanding these differences is crucial in choosing the right expense tracker for your business or personal needs.

Types of Expense Trackers Available Today

![]()

In today’s digital age, managing expenses has become more streamlined than ever, thanks to the variety of expense trackers available. Whether you’re an individual looking to stick to a budget or a business owner seeking to monitor expenditures, there’s an expense tracker tailored to your needs.

Mobile Apps

Mobile apps offer a convenient way to track expenses on-the-go. Many apps provide features like receipt scanning and automatic expense categorization. Popular options cater to various needs, from simple tracking to comprehensive financial management.

Spreadsheet Templates

For those who prefer a more hands-on approach, spreadsheet templates are a versatile option. They allow users to customize their expense tracking sheets according to their specific needs. Both Excel and Google Sheets offer a range of templates that can be tailored for personal or business use.

Web-Based Solutions

Web-based expense tracking solutions provide accessibility from any device with an internet connection. They often feature robust integration with financial institutions, automatically importing transactions from bank accounts and credit cards. These solutions typically offer advanced reporting and analytics, making them ideal for those seeking a comprehensive overview of their expenses.

Best Mobile Expense Tracker Apps for iOS Users

Managing expenses is simplified for iOS users with the help of top-rated mobile expense tracker apps designed for their devices. These apps offer a range of features that make tracking expenses easy and efficient.

EveryDollar

EveryDollar is a user-friendly expense tracker app that helps you manage your finances effectively. It allows you to create a budget and track your expenses in real-time.

YNAB (You Need A Budget)

YNAB is a popular expense tracking app that helps users manage their finances by assigning jobs to every dollar they earn. It offers features like automated savings and investment tracking.

![]()

Expensify

Expensify stands out for its powerful receipt scanning technology, which automatically extracts key information from receipts and creates expense entries. It’s suitable for both personal and business expense tracking, making it a versatile choice.

- Expensify’s SmartScan feature can read receipts in multiple languages and currencies.

- The app integrates with popular accounting software like QuickBooks and Xero.

- The free version offers basic expense tracking features, while paid plans add advanced features.

Top Expense Tracker Apps for Android

If you’re an Android user, here are the top expense tracker apps to help you track your expenses. Managing your finances is crucial, and using a reliable expense tracker app can make all the differences in staying on top of your spending and keeping your budget intact.

Among the numerous apps available, we will explore some of the best options, focusing on their key features and benefits.

Money Manager & Expenses

![]()

The Money Manager & Expenses app is a robust tool for managing your finances. It allows you to track your expenses, manage your accounts, and monitor your overall financial status. With its user-friendly interface, you can easily manage your money and make informed financial decisions.

Some key features include tracking expenses, managing multiple accounts, and generating financial reports. This app is a great choice for Android users looking for a reliable expense tracker.

AndroMoney

![]()

AndroMoney is a versatile app that helps you track daily expenses, manage budgets, and handle multiple accounts. Some of its special features include alerts when you’ve exceeded your budget and real-time expense reports.

Key features of AndroMoney include:

- Handling multiple accounts and currencies, making it ideal for users managing finances across different banks or countries.

- Real-time budget alerts that notify you when you’re approaching or have exceeded your spending limits in specific categories.

- Detailed expense reports that can be exported in various formats, including CSV and Excel, for further analysis or record-keeping.

- A cloud backup feature that ensures your financial data is safe and accessible across multiple devices.

- An ad-free version available for $3.99, offering excellent value compared to other expense trackers.

AndroMoney earns a high user rating, making it a reliable choice for Android users to manage their finances effectively.

Comprehensive Expense Trackers for All Platforms

For users seeking a comprehensive expense tracking solution that works across all platforms, several top-notch options are available. These trackers not only help in managing expenses and creating a budget but also provide insights into spending habits and overall finances.

Wallet by BudgetBakers

Wallet by BudgetBakers is a versatile expense tracker that supports multiple accounts and provides a clear overview of your financial situation. It allows for the categorization of transactions and offers detailed reports on spending.

Rocket Money (formerly Truebill)

Rocket Money is a comprehensive financial management tool that includes expense tracking, budgeting, and savings goals. It integrates with various financial institutions to provide a holistic view of your finances and accounts.

Simplifi by Quicken

Simplifi by Quicken offers a streamlined approach to expense tracking and budgeting, designed to be more user-friendly than Quicken’s traditional software. The app provides a comprehensive financial dashboard that gives you a quick overview of your accounts, spending, bills, and savings goals.

- Simplifi’s “spending plan” approach focuses on what’s left to spend after accounting for bills and savings goals.

- The app’s “watchlists” feature allows you to monitor spending in specific categories.

- At $3.99 per month, Simplifi offers a good balance of powerful features and affordability.

These comprehensive expense trackers are designed to meet various financial management needs, from personal budgeting to detailed expense tracking. By choosing the right tool, users can gain better control over their finances and make informed decisions about their money.

Business-Focused Expense Tracking Solutions

For businesses, managing expenses efficiently is crucial, and several software solutions are available to help. These solutions are designed to simplify the process of tracking expenses, making it easier for businesses to stay on top of their financials.

FreshBooks

FreshBooks is a well-regarded expense tracking software that provides businesses with a straightforward way to manage their expenses. It allows users to easily track and manage their expenses, create professional invoices, and monitor their financial health. With its user-friendly interface, FreshBooks makes it simple for businesses to stay organized.

![]()

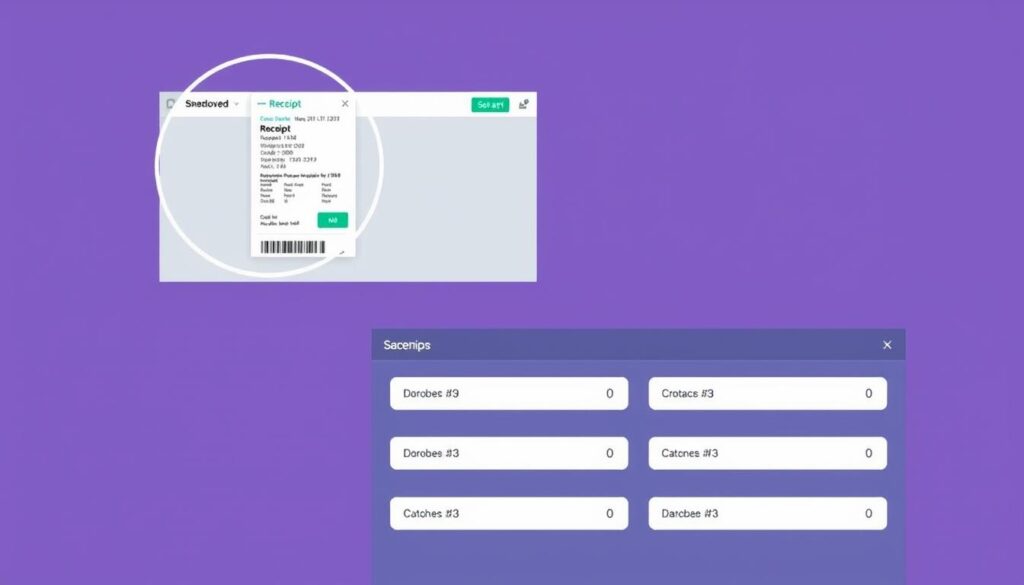

Shoeboxed

Shoeboxed is a top pick for its receipt tracking capabilities, making it an ideal solution for businesses looking to digitize their receipts and manage their expenses more efficiently. The service allows users to upload their receipts, which are then scanned and organized, making it easy to create expense reports. Although it has some limitations, such as the number of receipts that can be processed, Shoeboxed is a valuable tool for smaller businesses.

Free Monthly Expense Tracker Templates

For those seeking a straightforward method to monitor their expenses without committing to a specific software or application, free monthly expense tracker templates can be a valuable resource.

Excel and Google Sheets Templates

For users familiar with spreadsheet software, Excel and Google Sheets templates provide a familiar and flexible format for tracking expenses. These templates can be easily customized to fit individual needs, allowing users to create specific categories and track expenses over time.

Using these templates, users can take advantage of automatic calculations and easily monitor their budget throughout the month.

![]()

Printable PDF Expense Trackers

Printable PDF expense trackers

offer a tangible, low-tech solution for those who prefer pen-and-paper methods or don’t always have access to digital tools.

- These templates can be particularly effective for visual learners who benefit from physically writing down their expenses as part of their financial awareness practice.

- PDF expense trackers come in various formats, from simple daily expense logs to comprehensive monthly budget worksheets with multiple categories.

- Many printable trackers are designed to fit in standard planners or binders, making them easy to incorporate into your existing organizational system.

The physical nature of printable expense trackers can create a stronger psychological connection to your spending, potentially leading to more mindful financial decisions.

![]()

Key Features of Effective Expense Trackers

The key to successful financial management lies in choosing an expense tracker with essential features that simplify tracking your expenses and managing your money.

Automatic Transaction Importing

One of the most convenient features of modern expense trackers is the ability to automatically import transactions from your bank accounts and credit cards. This feature saves time and reduces the likelihood of manual entry errors, ensuring that your expense records are accurate and up-to-date.

Receipt Scanning Capabilities

Another valuable feature is receipt scanning, which allows you to capture and categorize receipts digitally. This not only helps in keeping your financial records organized but also makes it easier to track expenses and claim deductions during tax season.

Budget Creation and Monitoring

A good expense tracker should enable you to create and monitor budgets effectively. By setting financial goals and tracking your spending against them, you can make informed decisions about your money and stay on top of your financial health.

Reporting and Analytics

Reporting and analytics features provide insights into your spending patterns over time, helping you make more informed financial decisions. Key benefits include:

- Transforming raw expense data into meaningful insights to understand your financial behavior.

- Visual representations like charts and graphs to identify spending patterns and trends.

- Customizable reports to analyze your finances from different angles, such as expenses by category or time period.

- Cash flow analysis to understand where your money has gone and project future financial scenarios.

By leveraging these features, you can gain a clearer picture of your financial situation and make better decisions about your money and cash flow.

How to Choose the Right Expense Tracker for Your Needs

![]()

The process of choosing an expense tracker that fits your requirements involves considering several key factors. With numerous options available, it’s crucial to evaluate your needs carefully to select the most appropriate tool.

Assessing Your Financial Goals

Begin by assessing your financial goals. Are you looking to simply track your expenses, or do you need a more comprehensive tool that can help you create a budget and monitor your spending? Understanding your objectives will help narrow down the features you need in an expense tracker.

Considering Your Budget

Next, consider your budget for an expense tracking solution. While some expense trackers are free, others require a subscription or a one-time purchase. Evaluate the cost in relation to the features and benefits provided to ensure you’re getting value for your money.

Evaluating Ease of Use

Ease of use is crucial for long-term success with an expense tracker. Consider your technical comfort level and the time you’re willing to invest in learning a new system. Look for an expense tracker with a clean, intuitive interface that makes tracking your expenses straightforward. Mobile accessibility is also increasingly important for many users, so assess whether the mobile app provides the necessary features on the go.

By carefully evaluating these factors, you can choose an expense tracker that meets your needs and helps you manage your finances effectively.

Conclusion: Taking Control of Your Finances with the Right Expense Tracker

By leveraging the power of expense trackers, you can take control of your financial destiny and make informed decisions. An expense tracker is a great way to streamline your financial management by creating clear budgets, setting savings goals, and tracking your spending.

There are various expense trackers available, offering different features for personal and business tracking. The key is to choose the one that fits your unique financial situation and goals. Regularly monitoring your expenses is a powerful step toward financial empowerment.

Ultimately, an expense tracker is just a tool—the real power comes from the financial awareness and discipline you develop through consistent tracking and mindful spending. By doing so, you’ll be well on your way to achieving your financial objectives and securing a brighter financial future.

FAQ

What is the best way to track my expenses?

How can I manage my cash flow using an expense tracking tool?

Can I use an expense tracking tool to track my business expenses?

How do I choose the right expense tracking tool for my needs?

Can I track my debt using an expense tracking tool?

Are there any free expense tracking tools available?

How can I ensure that my expense tracking tool is secure?

Can I customize my expense tracking tool to fit my needs?

Eduard Kingly is a travel and lifestyle content creator with a focus on personal development and education. He combines firsthand travel experiences with research-driven insights to guide readers in discovering new places, building better habits, and pursuing meaningful learning.